Planning Your Dream Cruise: 3 – The Cost of Cruising – Financial Matters Afloat

This is the third in a series of articles by Sheryl and Paul Shard who have been cruising internationally and living aboard their Classic 37 sailboat, Two-Step, since 1989.

This is the third in a series of articles by Sheryl and Paul Shard who have been cruising internationally and living aboard their Classic 37 sailboat, Two-Step, since 1989.

Previously in this series, we talked about the importance of determining early on “why” and “where” you might want to go cruising to be sure that the voyage you design is a successful one for you and your crew and that the boat you have chosen is up to the task. In Part 3, we move on from the dream stages of cruise planning to the nitty-gritty practical steps of estimating the cost of your ideal cruise, designing a budget you can stick to, saving up for the trip, and managing your money from afar.

Determining the Cost

Most people believe that long-term cruising is expensive but it certainly doesn’t have to be. When we first cut the docklines in 1989 we were surprised at how our monthly fixed expenses dropped when we let the apartment go, sold the car, and suddenly didn’t have rent to pay or home and car insurance premiums. The cable TV fees stopped, as did our fitness club memberships. Costly commuting expenses disappeared. No longer working in offices, our clothing budget dropped drastically since our wardrobe simplified and cruising in the tropics didn’t demand several sets of seasonal clothes. And the space limitations of a boat discourages idle spending since there’s just not room to store the useless junk we’re often tempted to buy at home and frankly, in most of the remote places we chose to cruise in, there’s just not the selection of tempting stuff to buy!

Sure the home and car insurance changed to travel, medical and boat insurance, and commuting costs turned into boat fuel, repair and maintenance costs, but in general when you go cruising your needs and living expenses become more simple. In fact on our first cruise we lived so much at anchor that the money we’d saved for a one year sabbatical stretched into two years and then we were able to work along the way (more on that in Part 4: Making Cruising Pay) and so stretched the trip into a third year.

On that first cruise from 1989 through 1992, an Atlantic Circle, we cruised full-time, never returning to Canada, and during that voyage we spent $1,000 US per month on average cruising aboard our simply-equipped, self-maintained, 37-foot sloop. But the average is somewhat misleading. During the first 4 months of the cruise we were still doing some outfitting and, since we were still gaining experience and confidence, we stayed at marinas more frequently. We didn’t really try to stick to a budget, as we were just getting started and figured we really needed all that new stuff! Well, in those four months we spent almost the same as we did the whole following year! The third year of that cruise, we anchored almost all the time in idyllic spots from Brazil through the Caribbean and back to Canada. We fixed things on Two-Step and didn’t add much equipment so our expenses were more like $600-700 per month. Of course the month we spent at sea from the Canaries to Brazil and then on to Grenada was the cheapest of all–roughly $65 on groceries in Brazil!

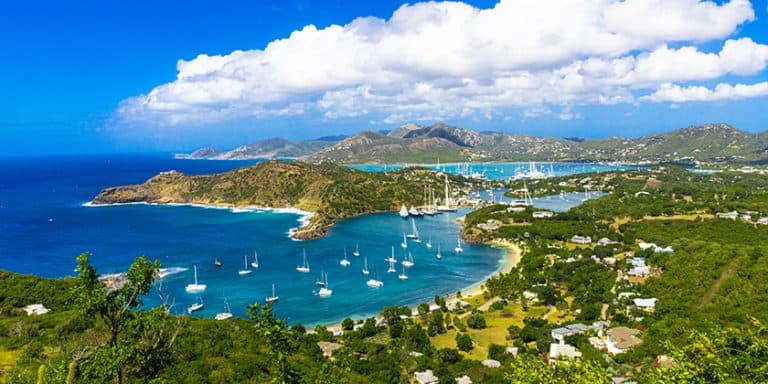

Our monthly expenses now, due to inflation and rate of exchange to the Euro while we cruise in the Mediterranean, can be anywhere from $2,000 – $3,000 US per month. Generally, there are fewer cruising grounds with lots of good anchorages throughout the Med as compared to the Caribbean (Greece, Turkey and Croatia excepted). So we’re back to spending more time in marinas as a result. Another factor is that we enjoy travelling inland to see the historic and cultural sites of Europe so every couple of weeks, we put Two-Step in a secure marina while we go off touring. When cruising island destinations such as the Bahamas and Caribbean you can see a lot on day trips that reduces costly transportation and hotel expenses. Fuel is a lot more expensive in Europe, about $1.50 per litre, and now that we have just purchased a larger boat, a Southerly 42RST built by Northshore Yachts in England, our marina fees will increase.

So as you can see, “where” you are cruising, the size of your boat, and your own personal interests and cruising style can greatly determine your expenses. So how do you figure out your potential costs ahead of time?

As I mentioned in an earlier instalment in this series, the best way to plan is to talk to everyone you can who has been cruising in the destinations you’re planning to visit and, ideally, has a similar sized boat to yours and likes to travel in similar style. Ask their advice about favourite marinas and anchorages in the area and the approximate costs they incurred sailing there. What items were expensive? How about fuel? Do they run their engine more or less than you including charging up the ship’s batteries or keeping the freezer going? Do they spend a lot on sightseeing or prefer to relax at anchor and do boat-related activities? How often do they keep in touch with home and what are their communications costs? Do they have regular guests? How often do they fly home? How old is their boat? Do they do their own repairs and if not what do they spend on maintenance in a year? All these things affect monthly cruising costs and asking the questions will give you good models to work from. There can be so many variables in the answer to “How much does it cost?”

Reading and attending presentations are also informative means of research as is surfing the Internet, a wonderful modern resource since so many cruising associations as well as cruising sailors publish web sites giving up-to-date information on worldwide cruising grounds. As an added bonus, you can often send them an e-mail through these web sites if you have a specific question to ask. Cruisers forums or bulletin boards are great too.

Designing a Budget You Can Stick To

Once you have an idea of costs, you can start to work out a budget for your cruise. At home and work you probably have a monthly budget to guide you, but with cruising you need to be a bit more flexible. You’ll probably spend more in the initial months as you discover things you are missing. Also, as the boat gets a serious initial shakedown many things tend to break and there seem to be more repairs necessary at the beginning of a cruise.

There is also a tendency early in a cruise to spend as if you are on a week’s holiday or charter–eating out every night, sightseeing constantly, loading the boat with souvenirs–things you wouldn’t do living day to day at home. On a long-term cruise it’s tough to keep that up since it wears at you physically and financially. Now your day-to-day life is on a boat instead of a house and once you settle into that idea your spending habits go back into balance.

Of course you don’t want to miss out on opportunities to sample local cuisine or see the sights but you soon realize the high quality experiences you can have without going crazy. Having said that, we have friends with large boats and large bank balances that can accommodate a high-priced lifestyle for long periods without putting much of a dent in their funds. So if it’s in your budget too and this fits the “why” you’re going cruising, all the more power to you! Cruising in company with boaters on a different budget than you can affect your spending positively or negatively since you tend to want to participate in the same activities.

So in general, it’s a good idea to determine what you want to spend over several months and then pull back here and there to maintain your budget if you’ve had to spend highly at certain times and in certain places.

Budgeting, however, is a personal thing and doesn’t work for everyone. We have friends who have gone on several long-term cruises and just hate budgets. So they decide ahead of time how much they have to spend and just cruise until the money runs out. Sometimes this means a shorter cruise than originally planned if they end up living high on the hog or have expensive unexpected repairs to make but one of the things they love is the freedom from restrictions and to them this includes strict budgeting. Whatever works for you, do it. Cruising is about pleasure.

It’s Easy to Reduce Costs

We find that as people adapt and discover the joys of the cruising lifestyle they find easy ways to live comfortably and affordably by reducing expenses without even trying. Like us, they may discover that they prefer to be in cool breezes at anchor rather than being tied up in an airless marina. They may find new pleasure shopping in exotic local markets for fresh foods and speaking with the characterful vendors there rather than just running to convenient more highly priced grocery stores. Having time to prepare delicious meals on board and entertaining new friends may become more appealing than eating out at expensive restaurants. After a while they may get “museumed out” and just stop and smell the roses rather than rushing around feeling pressured to see the sights in every place they arrive at. Over time they may learn and take pride in doing their own repairs and achieve more self-sufficiency that reduces maintenance costs. And the list goes on.

Saving for Your Voyage

Like budgeting, the process of saving is difficult for some people but saving for a cruise is fun because you’re looking forward to the trip. Cutting back on luxuries ashore takes on a new meaning when you see the cruising kitty grow. There are oodles of books written on saving and investment so I won’t get into great detail here but we have found that psychologically it works well to create a separate account or investment portfolio just for the cruise rather than lumping the money in with all your other savings. It somehow makes the cruise seem more tangible and you’re less tempted to tap into the funds for other things since you feel as if you are destroying or setting back your dream.

Managing Your Money From Afar

So you’ve been talking to other cruisers for advice on costs and have read as much as you can. You’re feeling pretty confident that you’ve nailed down a good estimate of the expenses that will be incurred during your upcoming cruise. The boat is equipped and ready to go. You are ready to retire or have arranged a sabbatical or leave of absence or fortunes have arranged it for you and you have some time to go cruising between contracts or your next job. There are sufficient funds in the bank for the voyage but how do you get access to them while you’re “out there”?

These days with online banking and automatic pre-authorized payments from your bank accounts it’s easier than ever to manage things from afar yourself but mistakes happen and a “real” person is always needed to correct them, make local calls, etc. so we still recommend having an appointed representative at home with Power of Attorney. Since communications are often tricky while cruising even with modern technology it’s important to appoint someone, usually a family member or very close reliable friend, to manage your bills and funds transfers for you. And since official documents need to be signed with your bank and a lawyer this must be organized before you set sail.

We move money from investments into our bank accounts and withdraw cash in the local currency from ATMs that are pretty much everywhere these days. This way we don’t have to travel with large amounts of travellers cheques or stashed cash that isn’t earning interest. Cash advance fees do apply when withdrawing from foreign ATMs but in the long run we have found this works out to be the safest and cheapest way to go for us. In some countries the ATM’s don’t allow you to access your accounts or automatically withdraw from your chequing account or only allow credit card cash advances. To avoid or reduce interest from credit card cash advances, transfer the funds into your credit card account before you do the withdrawal so there is a positive balance.

Paul and I always travel with a variety of credit cards issued from different banks. Some machines only accept certain cards and occasionally a card gets damaged or swallowed. By having other cards as back-up, we’re not left stranded. Something we’ve just discovered recently is that you can arrange to have your daily ATM cash withdrawal amount raised so that you can take out larger chunks of cash at one time to pay, for example, a local contractor for work done to the boat if he doesn’t accept credit cards. Before, we’d have to do several withdrawals over a few days and got charged a fee each day. You can also have your daily cash advance limit lowered if this makes you feel more secure in the event of theft.

As in all things related to cruising, flexibility and patience is required in the managing of money while you sail the seven seas. Advance research, reliable help at home, and keeping your goals in mind as you spend your hard-earned and well-saved cash can make your cruise all or more than you ever dreamed it would be.

In Part 4: Making Cruising Pay in the next issue, we’ll continue on the money track and discuss ways to keep the cruising kitty topped up while you travel. We’ll profile several cruisers, the work they do, how it affects the way they cruise, and discuss the pros and cons of working while cruising.

Paul and Sheryl Shard are the authors of the bestselling book, “Sail Away! A Guide to Outfitting and Provisioning for Cruising” and the hosts of the award-winning sailing TV series, “Distant Shores” which is also available on DVD. Visit their website www.distantshores.ca